Get the free rhode island tax form t 79 - tax ri

Show details

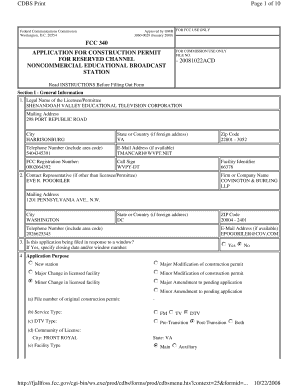

STATE OF RHODE ISLAND AND PROVIDENCE PLANTATIONS DEPARTMENT OF REVENUE DIVISION OF TAXATION ONE CAPITOL HILL PROVIDENCE RI 02908-5800 RI T-79 APPLICATION FOR ESTATE TAX WAIVER Name of Decedent Date of Death Decedent s Address City State Assessment Number Has Form 100 been filed Yes Zip Code No Number of shares or face amount of bond Name of Company Held in the name of A SEPARATE APPLICATION MUST BE COMPLETED FOR EACH COMPANY THIS FORM SHOULD BE T...

We are not affiliated with any brand or entity on this form

Get, Create, Make and Sign rhode island tax form

Edit your rhode island tax form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your rhode island tax form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

How to edit rhode island tax form online

Use the instructions below to start using our professional PDF editor:

1

Set up an account. If you are a new user, click Start Free Trial and establish a profile.

2

Simply add a document. Select Add New from your Dashboard and import a file into the system by uploading it from your device or importing it via the cloud, online, or internal mail. Then click Begin editing.

3

Edit rhode island tax form. Rearrange and rotate pages, add new and changed texts, add new objects, and use other useful tools. When you're done, click Done. You can use the Documents tab to merge, split, lock, or unlock your files.

4

Get your file. When you find your file in the docs list, click on its name and choose how you want to save it. To get the PDF, you can save it, send an email with it, or move it to the cloud.

Dealing with documents is always simple with pdfFiller.

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

How to fill out rhode island tax form

How to fill out t79 form:

01

Gather all necessary information and documentation required to complete the form.

02

Read the instructions carefully to understand the specific requirements for each section of the form.

03

Start by entering your personal information such as name, address, contact details, and any other relevant identifying information.

04

Provide accurate details about your income, assets, and liabilities as requested on the form.

05

If applicable, include information about your spouse or dependents as required.

06

Fill in the sections related to any tax credits or deductions you may be eligible for.

07

Double-check all the information provided to ensure its accuracy and completeness.

08

Sign and date the form as required.

09

Submit the form through the appropriate channel, which may include mailing it or electronically submitting it online.

Who needs t79 form:

01

Individuals who need to report their income and claim certain tax benefits or credits.

02

Taxpayers who have conducted financial transactions that require disclosure on this specific form.

03

Individuals who have been instructed by the tax authority to complete the t79 form for tax purposes.

Fill

form

: Try Risk Free

People Also Ask about

How do I avoid estate tax in Rhode Island?

Estate Tax Exemption Amounts Rhode Island: If a person's taxable estate totals less than $1,733,264* there is no estate tax to be paid. If the taxable estate exceeds $1,733,264, the estate tax is assessed on all assets of the decedent above the $1,733,264 exemption amount.

How can I avoid estate tax in RI?

For decedents dying on or after January 1, 2023, the credit amount is $80,395, exempting from taxation the first $1,733,264 of an estate. This means that, in general, if a decedent passes away in 2023, a net taxable estate valued at $1,733,264, or less, will not be subject to Rhode Island's Estate Tax.

What is the gift tax in Rhode Island?

Rhode Island also has no gift tax. The federal gift tax has an exemption of $16,000 per person per year in 2022 and $17,000 in 2023.

What is the estate tax exemption for 2023 in RI?

Rhode Island estate tax credit and threshold set for 2023 This means that, in general, if a decedent passes away in 2023, a net taxable estate valued at $1,733,264, or less, will not be subject to Rhode Island's Estate Tax.

Is there a difference between inheritance and estate tax?

Estate and inheritance taxes are taxes levied on the transfer of property at death. An estate tax is levied on the estate of the deceased while an inheritance tax is levied on the heirs of the deceased.

Does Rhode Island have an estate or inheritance tax?

The Estate tax is imposed upon the transfer of the net value of the assets of every decedent with actual situs (both real and personal property) in this state.

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

How do I edit rhode island tax form online?

The editing procedure is simple with pdfFiller. Open your rhode island tax form in the editor, which is quite user-friendly. You may use it to blackout, redact, write, and erase text, add photos, draw arrows and lines, set sticky notes and text boxes, and much more.

How do I make edits in rhode island tax form without leaving Chrome?

Adding the pdfFiller Google Chrome Extension to your web browser will allow you to start editing rhode island tax form and other documents right away when you search for them on a Google page. People who use Chrome can use the service to make changes to their files while they are on the Chrome browser. pdfFiller lets you make fillable documents and make changes to existing PDFs from any internet-connected device.

Can I edit rhode island tax form on an iOS device?

Use the pdfFiller app for iOS to make, edit, and share rhode island tax form from your phone. Apple's store will have it up and running in no time. It's possible to get a free trial and choose a subscription plan that fits your needs.

What is rhode island tax form?

The Rhode Island tax form is a document used by residents and businesses in Rhode Island to report their income and calculate the state income tax owed.

Who is required to file rhode island tax form?

Individuals and businesses that earn income in Rhode Island, as well as residents who earn income elsewhere, are required to file a Rhode Island tax form.

How to fill out rhode island tax form?

To fill out the Rhode Island tax form, gather your financial information, complete the form by entering your income, deductions, and credits, and submit it to the Rhode Island Division of Taxation either electronically or by mail.

What is the purpose of rhode island tax form?

The purpose of the Rhode Island tax form is to collect state income tax from residents and businesses to fund public services and government operations.

What information must be reported on rhode island tax form?

The information that must be reported on the Rhode Island tax form includes personal identification details, total income, allowable deductions, tax credits, and the calculated tax owed or refund due.

Fill out your rhode island tax form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Rhode Island Tax Form is not the form you're looking for?Search for another form here.

Relevant keywords

Related Forms

If you believe that this page should be taken down, please follow our DMCA take down process

here

.